Blog

Monday, March 24, 2025

Cutting Medicaid is Possible

In February, Republicans announced their intention to cut $2 trillion in spending over the next 10 years. $880 billion of that is to come from the Committee on Energy and Commerce (See Title II), which oversees Medicare, Medicaid, national energy policy, environmental protection, and several others.

Just doing basic searches on Medicaid cuts, trying to find information, all of the top stories include a warning about how many people are going to be hurt by this, but interestingly, there are no mentions of how much Medicaid has grown in the past ten years, even beyond its ACA expansion, how fast it's projected to grow, or how much waste could be cut. Every story just assumes, without including details, that every penny of Medicaid goes to children, poor adults, or disabled adults, but given the recent expansions, this seems unlikely.

The Recent Run-Up in Medicaid

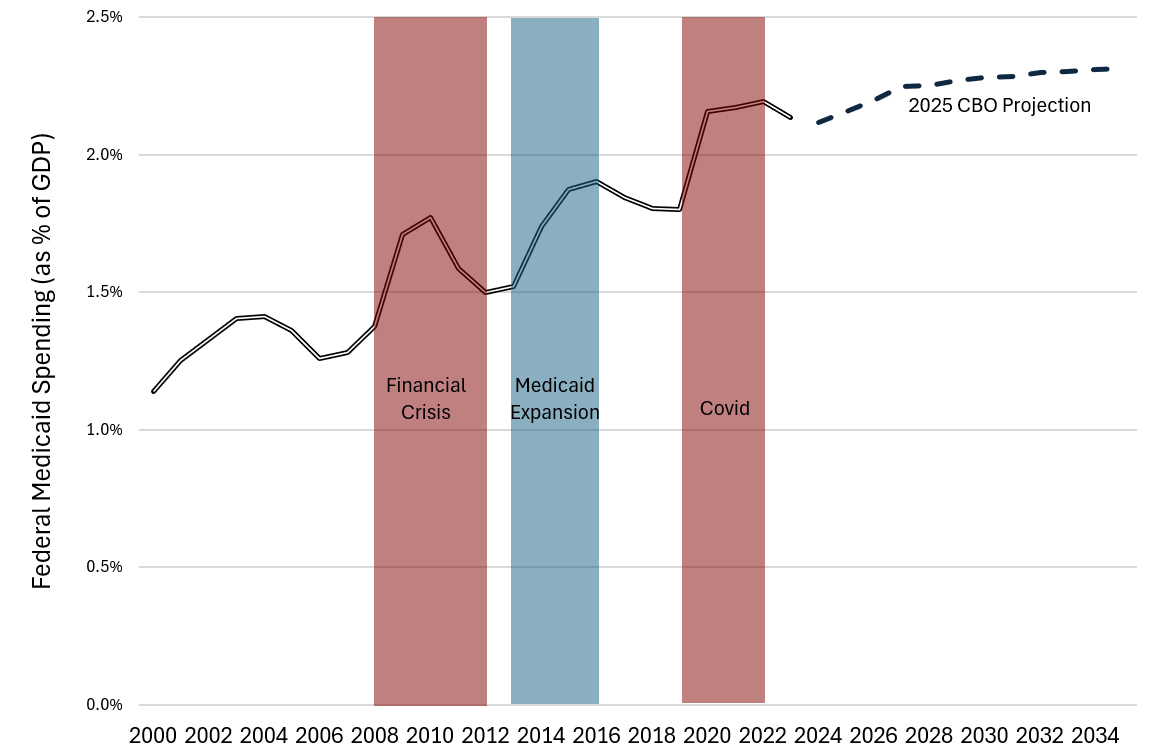

Since 2000, federal Medicaid spending has been trending upward. In 2000, after 8 years of a Democratic president, federal Medicaid spending was just 1.1% of GDP, and it has nearly doubled since then. Some of that surely is the increasing cost of medical care, but it's also driven by enrollment growth due to expanded eligibility and state incentives to get matching federal funding.

Federal Medicaid Spending as a % of GDP

Source: Author Calculation based on NHE (Actual Federal Medicaid Expenditures), FRED (Actual GDP), CBO (Projected Medicaid and GDP)

In the last twenty-five years, the largest, single-year increase in federal Medicaid spending occurred in 2020, the year of Covid. This, in and of itself, is unsurprising, but what's harder to understand is why it has barely fallen back to its pre-Covid rate, even four years later, while the economy has boomed.

In the last twenty-five years, the largest, single-year increase in federal Medicaid spending occurred in 2020, the year of Covid. This, in and of itself, is unsurprising, but what's harder to understand is why it has barely fallen back to its pre-Covid rate, even four years later, while the economy has boomed.

Waste, Fraud, and Abuse

CMS periodically estimates the total "improper payments" in Medicare and Medicaid. The most recent estimate for Medicaid is that 5.1% of total Medicaid payments are "improper." While that sounds like fraud, in fact, the majority of these improper payments are simply insufficiently documented legitimate payments. They also estimated how much of the improper payments were actually illegitimate and found that 20% of them are truly improper and should not have been paid out.

Applying this rate of illegitimate payments to the CBO's ten-year forecast produces an estimate of $91.2 billion over ten years that can be saved without harming Medicaid recipients.

Applying this rate of illegitimate payments to the CBO's ten-year forecast produces an estimate of $91.2 billion over ten years that can be saved without harming Medicaid recipients.

Locking in Normal Growth

One approach Republicans might consider would be to lock in overall Medicaid growth to match its 2016-2019 rate. This was a time of a stable economy, after the major ACA expansion and before further expansions under Covid-era policies and the Biden administration. It represents a steady-state era for Medicaid.

During this time, Medicaid grew at 3.1% per year. This would represent smaller growth than the CBO estimated (between 4 and 5% per year).

Federal Medicaid Spending Growth by Year 2000-2024

Source: Author Calculation based on NHE (Actual Federal Medicaid Expenditures), CBO (Projected Medicaid)

Holding growth in Medicaid to the 2016-2019 average over the next ten years would save $778 billion. Considering that 2016-2019 was a time without major cuts to Medicaid benefits or eligibility, it would seem possible to lock in that growth rate without harming any beneficiaries.

Federal Medicaid Spending if Growth Held to 2016-2019 Rate

Source: Author Calculation based on NHE (Federal Medicaid Expenditures), CBO (Projected Medicaid)

Locking in Enrollment Levels

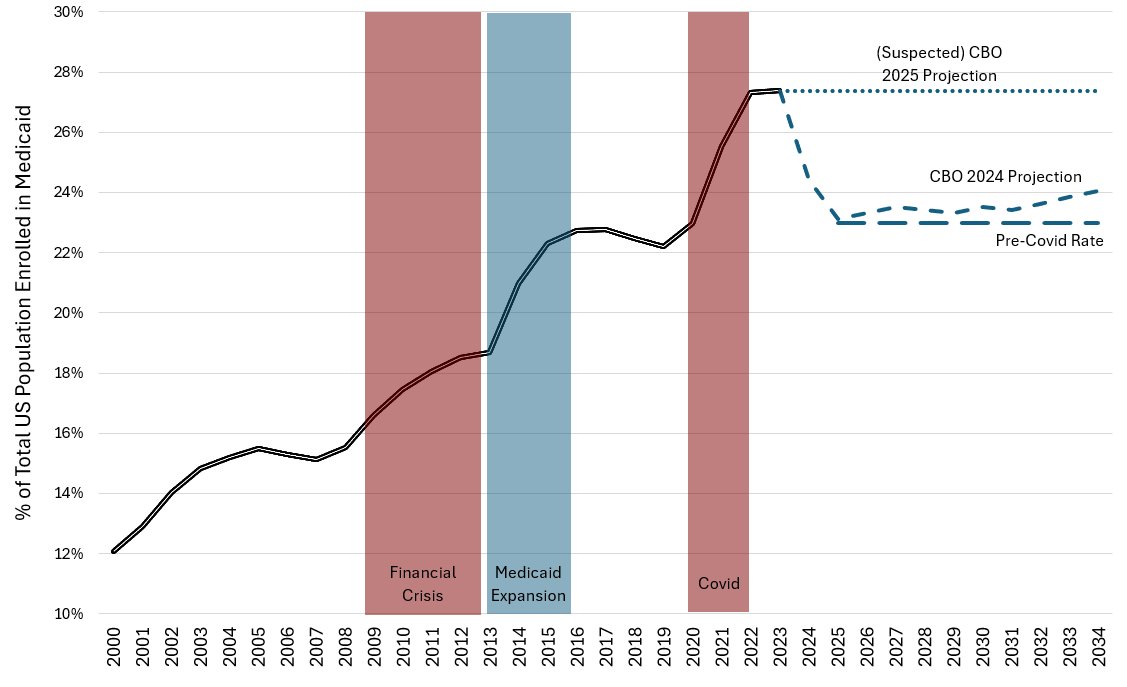

Another path Republicans might take is setting an enrollment target for Medicaid, which is supposed to assist the poorest Americans, yet enrolls close to 1 in 4. According to poverty statistics, before accounting for transfers 11.1% of Americans are impoverished. Medicaid, however, covered 27.4% of the US population in 2023.1

From 2000 to 2023, enrollment in Medicaid has grown from 12% of the population to 27% of the population, more than doubling, even though the federal poverty rate has barely moved, going from 11.3 to 12.5%. Some of that, obviously, was intentional, as the ACA expanded Medicaid, but in 2019, before the pandemic hit, and after state expansions had taken place, Medicaid penetration was only 23.0%. Since Covid, it has risen several percentage points, even without expanding Medicaid in large states like Texas and Florida.

% of Total US Population enrolled in Medicaid by Year

Source: Author Calculation based on NHE (Total Medicaid Enrollment), CBO (Projected Medicaid Enrollment). Note: The 2025 CBO projection for Medicaid spending is substantially higher than the 2024 CBO projection, but they have not yet released the breakdown. The dotted line represents a higher level of enrollment which could explain the higher CBO estimates.

Setting a maximum Medicaid enrollment of 23.0%, the highest level it reached before Covid and after the ACA expansion, would save $1.4 trillion over the next ten years.

Capping Medicaid enrollment at its pre-Covid peak would save $1.4 trillion over the next ten years.

Federal Medicaid Spending if Enrollment Held at Pre-Covid Maximum

Source: Author Calculation based on NHE (Total Medicaid Enrollment), CBO (Projected Medicaid Enrollment)

Conclusion

Rolling the Medicaid program back to the pre-Covid norm, when there were no significant criticisms of its inadequacy, would save more than Republicans are pushing for.

Medicaid has expanded in scope and scale over the past twenty-five years and has grown to a point where some pruning can be accomplished without the devastating results that many warn will occur. Simply rolling the program back to its scale from prior to the pandemic would provide more money than Congress is looking for and would return Medicaid to funding and enrollment levels that, at the time, drew little to no criticism.

Notes

For a counterargument, Kaiser Family Foundation claims it's impossible.

For some supportive analysis and a more detailed proposal for Medicaid, Manhattan Institute

Stray Thoughts

One of the explanations CBO gave for increased expected Medicaid spending from 2026-2035 was new spending on GLP-1s, which reduce obesity. Theoretically, though, the reduction in obesity should also lead to improved health and reduced spending. I'm curious if that is included in their estimates.

Footnotes

1This number has fallen in 2024 as the Medicaid expansions from the Covid-era are being unwound. The rate today is between 25 and 26%.

Tuesday, January 7, 2025

The Argument Against Extending ACA Subsidies

In what should come as no surprise, Republicans are warming to the expanded ACA that was designed, implemented, and already extended once by Biden along with the Democratic-controlled Congress. I recently wrote about how our elected officials have lost the ability to exhibit the responsibility and fiscal restraint that existed just a few decades ago, and this is yet another example.

These subsidies shouldn't be expanded for six reasons:

- The ACA was designed to increase subsidies as premiums rose and set definitions of affordability that ensured low-income Americans could afford to purchase insurance no matter the price.

- The ACA focused on people above the poverty line, and paid subsidies to people earning much more than the poverty level, even beyond the median household income.

- There is no reason that the affordability thresholds set by the ACA were too high and need to be reduced.

- Expanded subsidies have not led to uniform gains in coverage at all affected incomes, and the apparent gains are questionable.

- Increased subsidies will generally increase premiums, which will end up hurting taxpayers and people ineligible for subsidies while benefitting insurance companies.

- As always, given debt levels, spending more nonexistent money to make, at best, minor enhancements to a program with many other problems is unjustified.

ACA Already Set Subsidies to Make Health Care Affordable

One of the major features of the Affordable Care Act was the subsidies it paid to people earning too much to qualify for Medicaid, to be used to purchase insurance on the exchanges. The subsidies were designed on a sliding scale, to bridge the gap between what the ACA determined people could afford, and the current cost of insurance. The lower a person's income, the higher the subsidy. The higher their income, up to 4 times the federal poverty level, the lower the subsidy.

According to the original legislation, which Obama signed and every Democrat lauded for a decade, every American, regardless of their income level was expected to pay at least a little bit for their health insurance. For people making less than 133% of the Federal Poverty Level (FPL), Obama and Democrats believed contributing at most 2% of their monthly income was affordable. For a single-person right at the poverty line, that would amount to $20/month. For a family of four, less than $40/month. The government/taxpayers would pay the rest via a subsidy.

What often gets lost in discussions about ACA subsidies is that while these subsidies go to individuals and families who are low-income, they are not going to anyone living in poverty, by the government's definition. "% FPL" is a term used frequently in policy circles, but it's important to remember what it signifies--how much more income a person makes compared to someone living in poverty. The ACA, as originally legislated, focused its subsidies on Americans earning above the poverty level but no more than four times the poverty level.

In 2014, the median household income was $53,657 (2014 $), but subsidies were available to households up to 4 times the federal poverty level, which would amount to $71,040 for a household of 2.5 people (the national average). The diagram below shows how the subsidy availability compares to the income scale. In 2014, 300% FPL was pretty close to the median household income, meaning that subsidies were available well into the middle class of Americans.

One of the smart elements of the ACA was the definition of affordability was in terms of percentage of income. This produced several benefits. For one, it would prevent medical inflation from affecting the subsidy. For instance, if health care costs doubled, and premiums consequently doubled, while incomes remained stagnant, then the subsidy would cover the entirety of the premium inflation.

Defining affordability as the maximum percentage of income people should be expected to pay for health insurance meant that annual updates would be unnecessary and affordability would incorporate both the increase in health care premiums and changes in income. There would be little need to change it going forward. Beyond that, Democrats have been celebrating the slow growth of ACA premiums.

However, in 2021, for no particular reason, Biden and Democrats modified the thresholds so that, at every income level, the expected contribution of people to their health care premiums would fall, for most people by more than 50%, and for a large proportion, so that they were no longer expected to contribute anything. The expanded subsidies were only supposed to last through 2022, presumably covering the pandemic, but in the Inflation Reduction Act, the Democrats extended through 2025.

Affordability Redefined - Changes in Expected Contribution by Income Level

The table above shows the amount that people at various income levels were expected to contribute under the original ACA and under the expanded subsidies. President Obama and the Democrats of 2010 considered $25/month affordable for people just above the poverty threshold, and a gradually increasing amount for people making several multiples of that threshold. President Biden and the Democrats of 2021 substantially redefined affordability. In fact, Biden cut the expected contributions more if you were higher income than if you were lower income. While that may not be clear based on percentages, reducing contributions 4% for a higher income is a greater dollar reduction than for a lower income.

Also, bear in mind that these expected contributions are based on a Silver plan, which has higher premiums and lower out of pocket costs than a Bronze plan. Given Bronze plans are generally cheaper, in most cases, they would already be available for zero premium dollars for people between 100 and 200% of the federal poverty level.1

Like much of the other spending in the ARPA (for instance union bailouts, school slush funds, and an additional stimulus check), the expanded subsidies were not really necessary and were insufficiently debated and discussed, but got smuggled through because on their face, they seemed reasonable given the pandemic.

Subsidies Available to Way More Than Most Needy

Subsidies Raise Prices and are Captured by Corporations not Consumers

History has shown that subsidizing consumers often leads to increases in the list prices of the product. Sometimes, the increase in price completely offsets the subsidy meaning the money intended to help consumers ends up having no effect on their well-being at all, but goes to the company selling the product instead. This relationship has been borne out in education, housing, farm rental, child care, and solar panels.

Generally, this effect is more pronounced when supply of a good is limited, such as with housing or child care. In this case, while insurance products themselves are effectively unlimited, the premiums eventually go to a product that is limited - health care. To the extent that coverage leads to unnecessary utilization, it will lead to price increases for providers and premium increases for everyone.

Gains in Insured Population Are Questionable and Uneven

Since the enhanced subsidies, total ACA enrollment has nearly doubled, but looking more closely, gains have not been uniform across all the income levels. 60% of the growth in enrollment came from the 100-150% FPL and 71% of the growth came from people earning less than 200% of the FPL. On a per-beneficiary basis, these were the smallest changes in subsidy, but for these people their benchmark premium fell to zero. If the goal is to maximize enrollment, then dollars are best spent on the lowest income participants. This has the secondary benefit of being more in line with a system that focuses its social safety net on those most in need.

71% of the growth in enrollment came from the people who received the smallest boost in subsidies.

The Paragon Health Institute conducted its own review of the gains and compared to the number of people who would be eligible for subsidies at these income levels. They found that for many states, there was greater growth in enrollment than there were people in those states. They also found that reported incomes more often than would be expected, exactly matched the income thresholds that would warrant the subsidies. Consequently, they concluded that a 5 million of the newly insured were misstating their income to receive the subsidies. Before extending these subsidies, the government should redouble efforts to make sure only the people who deserve them are receiving them.

Further, there's reason to question the CMS enrollment numbers themselves. According to those numbers, ACA enrollment from people earning between 100 and 199 of the federal poverty level has more than doubled, adding millions of new beneficiaries in this group. The National Health Insurance Survey, though, shows no such growth in private ACA enrollment through 2023, the most recent available.

Insurance Coverage Levels for 0-64 year olds between 100-199% of FPL

Source: Lynn A. Blewett, Julia A. Rivera Drew, Miriam L. King, Kari C.W. Williams, Daniel Backman, Annie Chen, and Stephanie Richards. IPUMS Health Surveys: National Health Interview Survey, Version 7.4 [dataset]. Minneapolis, MN: IPUMS, 2024. https://doi.org/10.18128/D070.V7.4

The Ever-Present Debt

Lastly, of course, is the same argument against all new spending--there is no money to spend. Deficits are increasing more every year and will continue to for decades. New spending today will mean some combination of reduced services or higher taxes for the next generation. As with all spending, if you're in favor of this, if you think it is important and substantially beneficial, it should be no problem to name something that is less important, that is less beneficial, that is a worse use of money. Unless that can be named, and money shifted, then new spending should not be added.

Put slightly differently, and others don't report it this way, but every deficit dollar we spend today, is actually a commitment to spend more than double that over the next twenty years. It's a commitment to spend 7x that over the next 50 years, because every dollar we spend we have to borrow, and we never pay it back. So year after year, we're paying interest. Imagine you took out a 30k loan for a car that you didn't have to payoff for fifty years, and you never paid back the principle. You'd end up spending $213,000 over the fifty years and still owe more. The CBO predicts a baseline interest rate of 4% going forward, but there are many reasons to believe that that interest rate will increase as our debt increases and the United States falls deeper and deeper into debt.

As worrisome as the graph above looks, the reality will probably be worse because of the likelihood of higher interest rates as the debt mounts but also because CBO forecasts don't account for surges in spending due to recessions or spendthrift leadership.

Don't Extend the ACA Subsidies

There are plenty of reasons to be circumspect about the ACA subsidy expansion. Unfortunately, it's a lot easier to avoid careful review and not worry about the budget, the effectiveness of your spending, or fraud but bask in the adulation you get from blindly spending other people's money on a problem people wish was fixed.

Notes

1On average, Bronze plans' premiums are around $100 lower than Silver plans' premiums, so if your expected contribution is below $100 for the second-lowest cost silver plan, the subsidy you receive will be greater than the cost of the bronze plan.

Monday, December 30, 2024

Social Security and the End of the Age of Responsibility

Background

On December 21st, Congress reiterated its disinterest in fiscal prudence. While its free-spending inclinations have long been obvious, the affliction is certainly getting worse, illustrating a broader surrender to populism.

On December 21st, Congress passed the cheerily named "Social Security Fairness Act". With this act, they dismantled a 41-year-old, reasonable compromise passed overwhelmingly by a Democratic Congress and Republican Senate and signed into law by Ronald Reagan.

The Reasonable Provisions Being Repealed

If two people both worked a fast-food job part-time for their whole lives but one of those people also had a full-time government job with a lifetime pension that pays more than Social Security, while the other one never held another job, should they receive the same Social Security benefit?

While explanations of what this act does immediately defy a normal person's interest, the rationale behind the WEP and GPO provisions is eminently sensible.

Social Security was designed during the Great Depression to ensure that everyone was eligible for some income and a retirement in their later years. It would reduce any necessity for people to work the entirety of their lives. Moreover, it was intended to provide proportionally more for low-income workers than high-income workers. Like the progressive tax structure, the formula used to calculate benefits, was more favorable to low-income workers.

With taxes, lower income workers pay a lower percentage of their income, but with Social Security, it works in the reverse direction. Social Security basically is designed to replace a percentage of your income in retirement, and for lower-income workers, that percentage is higher. What the designers of Social Security didn't account for, however, are people who split their working lives between a Social Security-eligible job and a Social Security-exempt job. Readers may not be aware, but there are certain jobs, generally government jobs, where workers pay into and receive a government pension in lieu of Social Security. They do not pay Social Security taxes, and they do not receive Social Security benefits.

The progressivity of the formula would have worked as intended as long as people were in one or the other, but a problem arose because some people worked a Social Security job for part of their lives and a non-Social Security job for another part. Even if the worker worked full-time her whole life and received her full government pension in retirement, the Social Security formula assumed she spent half her life unemployed, and replaced a high percentage of her income as it was designed to do to support low income workers.

The Windfall Elimination Provision (WEP) was designed to address that. It didn't remove her Social Security benefits entirely, but it adjusted them down to account for the fact that this isn't a low income person, and so shouldn't receive the favorable benefit calculation that was intended for them. It was entirely reasonable, aligned with the program's intent, and improved the financial outlook.

The Perception of Unfairness

Unfortunately, these provisions created a perception of unfairness. It meant two people who paid the same amount into Social Security could receive different benefits. This outcome offended an intuitive sense of fairness. Of course, in the broader sense, it was supposed to be unfair, the way progressive taxes are unfair. Rich people pay more taxes because they're better able to afford it. Likewise, two people who paid the same into Social Security shouldn't get the same benefit if one of those people was poor and had no other source of income.

The Effect

The average pensioner, who, for the last forty years, received reduced Social Security benefits given their pension income, retires at 62, three years earlier than people on Social Security. And for income, 61% of the people whose Social Security benefits were cut due to WEP are earning more in retirement than the average Social Security beneficiary. Nearly 1/3 of the people who will get a Social Security raise are already earning more than twice as much from their pension.

Nearly one third of people who will get a Social Security boost are making more than two times the average Social Security recipient.

This is an entirely unnecessary change in Social Security, but it again highlights how political culture has changed. Forty years ago, elected officials had enough wherewithal to say no to their constituents, that the greater good required some sacrifice, that not everyone could benefit in all things in perpetuity. That restraint has been dwindling ever since.

Republicans used to at least talk about cutting ballooning, unpaid-for entitlements, but have completely abandoned that because it was hurting them. During the presidential campaign, both candidates promised to expand tax credits and cut taxes for important groups. No one mentioned cutting spending or the debt.

Fifty years of increased deficit spending with no adverse consequences has taught the public and the politicians seeking their votes to make ever-growing promises unconcerned with the eventual bill.

Other Links

Center on Budget and Policy PrioritiesAmerican Enterprise Institute

Tuesday, December 10, 2024

Democrats' Deal with the Devil

From the Invasion of Iraq to 2020, Democrats unquestionably held the moral high ground in politics. Bush led the war in Iraq where tens of thousands of people were killed without as much to show for it as he promised. Obama ran on hope, change, and unity. Democrats were the party of healthcare, education, science, diversity, and good government. Republicans were the party of rich people, tax cuts, laissez-faire economics, and an aggressive foreign policy.

When Trump was elected, this perceived moral gap between the parties grew even larger. Trump (and Republicans) were racist, misogynist, xenophobic, corrupt, anti-science, and every other bad thing you can think of.

Conversely, Joe Biden was a saint.

For four years, many, including myself, have been arguing that Joe Biden was not a good person, he was just better than Trump. If not for Trump, though, Biden would have been the worst person in terms of character to be President since Lyndon Johnson. I maintained a list of things Biden did while President that showed a deficiency of character. Things that he did as a bad person, and things that he did that made him a bad leader.

Now, four years later, a few of those things have allowed many Democrats to realize this, too. Particularly the last year where he stubbornly remained in the race for President even though he was headed for failure, undermined his VP's candidacy, and pardoned his son.

The result of this chain of behavior, and its national prominence and undeniability, is the Democrats have surrendered the moral high ground (and here).

Democrats made a bargain with the devil. They nominated a morally deficient politician because he was their best chance at getting rid of someone worse, then they boosted his ego by lying about his moral stature, and it came back to bite them.

Not only did Biden lose, and the guy they deemed worse is back in office, but Biden has now destroyed precedent after precedent and sledgehammered some walls that held back presidential power just in time for Trump to turn those new abilities toward his own goals. The Democrats' ability to criticize and appeal to the public are greatly diminished because Biden conspicuously laid the groundwork and the media discredited itself by lying on his behalf and then getting caught holding the bag.

Monday, November 11, 2024

Why Harris Lost

Many others have offered myriad explanations for how Trump defeated Harris. Some think Harris lost because she didn't appeal enough to women. Some argue that Biden stayed in the race too long, and it doomed Harris because she didn't have enough time to win. Some say it was trans issues. Some say it was inflation. Some even say that Trump voters were duped by a disinformation bubble.

Here are a couple rundowns of reasons from Vox and AEI. I find this explanation closest to my own view, and below, I explain it more comprehensively.

I'm a long-time proponent of the median voter theorem. The concept is more simple than the name. The idea basically is that to win an election, a candidate needs to win a majority of the votes, and to win the majority of the votes, that candidate has to win the vote of the median voter--the voter exactly in the political center of all voters. The candidate who wins that voter, generally by staking positions closest to them, wins the election.

The story of 2020-2024 is that in 2019 Harris was pretty far to the left, and lost the primary. Biden was pretty close to the center and won it. In the general election, he campaigned as a perfect centrist. However, once he became president, he shifted to the left and stayed there. When Harris took over, she moved up to, but not beyond where Biden governed, which left Trump much closer to the center than Harris, so Trump won.

In 2020, Joe Biden ran as a moderate

The 2020 Democratic primary featured candidates spanning the entire Democratic party, from Sanders and Warren representing the far-left to Biden, Buttigieg, and Klobuchar representing less far-left. And of them, Biden had the most experience, name recognition, and political power.

Once he won the nomination, he campaigned on ending the pandemic, but never said how. He was ambiguous on fracking. He thought Trump's immigration restrictions were too restrictive.

The Brookings Institute: "Joe Biden appealed to the center of the electorate across party lines. He did 10 points better than Hillary Clinton among Independents, and he doubled her showing among moderate and liberal Republicans...If the Democratic Party is regarded as going beyond what the center of the electorate expects and wants, Democrats' gains...could evaporate."

The BBC: "Biden stuck with a centrist strategy, refusing to back universal government-run healthcare, free college education, or a wealth tax. This allowed him maximise his appeal to moderates and disaffected Republicans during the general election campaign."

Biden won independents by 9 points--52 to 43, when Clinton had only won them by 1 point in 2016.

Joe Biden barely won his election

Even with all the benefits of running against one of the most singularly despised candidates in decades, a pandemic roiling the economy and the culture, civil unrest, record-setting fundraising, Biden only barely defeated Trump in the electoral college. Biden won three states by less than 1% of the vote--Georgia (0.23%), Arizona (0.30%), and Wisconsin (0.63%). Combined, Trump lost by a total 42,918 votes.1

Votes are still being counted in the 2024 election, but at the moment, Harris's easiest path would have needed to swing Pennsylvania, Michigan, and Wisconsin to have won the election. She would need to swing 255,000 votes. The differences in margin are 1.2% (PA), 1.4% (MI), and 0.8% (WI). Not quite as close as 2020.

Biden Moved Left

Once in office, President Biden swiftly moved left. He issued executive orders "at a record pace," signing more executive orders in his two days than any other president signed in his first 30. His executive orders were not just undoing President Trump's work, or meant to address the pandemic, but showed that he was "taking steps Democrats have long demanded on immigration, the environment and racial justice."

In his initial flurry of executive actions, Biden required masks on federal property, extended foreclosure and eviction moratoriums, froze student debt collection, revoked the permit for the Keystone Pipeline, cancelled other energy rules created under the Trump administration, and pulled back on immigration enforcement. While many of these were demanded by Democrats, even the ones that were arguably centrist positions at the time, came to represent a immoderate president.

In February, Biden indicated he was more beholden to the teachers' unions than science when he waffled on re-opening schools. The head of the CDC, Rochelle Walensky indicated it was safe to re-open schools, but teachers unions scoffed, and the Biden administration fell in line and called for more funds before they could re-open.

In March, Joe Biden nominated Lina Khan to be an FTC Commissioner, notably, not the chair. Lina Khan was notable for writing a very famous article calling into question the application of anti-trust law to the current slate of American tech companies, most prominently Amazon, because they served as platforms that gave their products away for free, so the conventional approach of using price increases to prevent monopolies wasn't reliable.

She went on to work for other Democrats, and was considered a talented but pretty far-left expert on anti-trust in the digital age. Many Senators thought being a commissioner was acceptable given it was the President's prerogative, and the FTC could have three Democrat-appointed commissioners. One of them being more progressive was unobjectionable. However, immediately after she was confirmed with bipartisan support, she won confirmation in a 69 to 28 bipartisan vote, President Biden named her the chair of the FTC.

"Her appointment was a victory for progressive activists" according to the New York Times and was "hailed by many Democratic lawmakers." Elizabeth Warren said "With Chair Khan at the helm, we have a huge opportunity to make big, structural change..." The Vice President of NetChoice said she would make the independent agency more political. In office only briefly, she embarked on a aggressive agenda to push the FTC firmly in the progressive direction.

This episode symbolized Biden's move from moderate campaigner to aggressively progressive president. No one expected he would put Lina Khan in change of the FTC, even when she was nominated for commissioner. The change was a shock not only because it was unexpected, but it was unprecedented for a President to have misled Senators and the public on his intentions. In addition, while the business world had strongly supported Biden's campaign, their support of him surely wavered with such an anti-business Democrat put in charge of the FTC.

These are just two early-on instances of his lurch to the left, especially as compared to how he campaigned. There were many more. There was Merrick Garland going after parents who were concerned about what their kids were being taught, labelling them as terrorists; there was the student debt relief which he had avoided during his campaign and steered clear of, but then decided to pursue unilaterally despite previous arguments that it was unconstitutional. He tried to require masks on planes and vaccines for workers. Both of which failed in court. Both of which he continued to pursue despite their unpopularity. He always sided with unions and decided he'd be the first president to stand in a picket line. He discontinued natural gas exports. He tried to apply the protections in Title IX, which was meant to prevent discrimination based on a person's sex, to trans students. Biden also moved to aggressively reduce the number of gas-powered cars and replace them with EVs and his administration briefly contemplated banning gas stoves before it went public.

Biden was so committed to not enforcing the border, he wouldn't enforce his vaccine mandate for illegal immigrants even though he did for travelers. He flew illegal immigrants all over the country though he did his best to keep it quiet. He created an app so that illegal immigrants could bypass the border altogether and schedule their entry via airplane. Lastly, when there was a misunderstood photo of the border patrol and a border crosser, he immediately sided with the immigrant and never apologized for his mistake.

Also remember that the Build, Back, Better agenda was originally another multi-trillion dollar package for which many Democrats tried to expand the definition of infrastructure to include their economic agenda.

The result of all of these individual items and moves was that Biden was perceived by many, on the left, and the right, and the center, to be the most left-wing president of the last fifty years. People compared him to FDR and he basked in it.

Biden's Approval Rating Suffered

Source: 538

The other, more significant, consequence of Biden's policy portfolio was an approval rating that danced around 40% for most of his presidency. It's well-known, that his approval rating plummeted after the botched Afghanistan withdrawal. It reached its lowest point in July of 2022, almost a year later, and just before the Chips and IRA bills passed in August. He enjoyed about six months of approval in the low 40s, before it started dropping again. From December 2023 up until his disastrous debate, his approval was slightly below 40%.

Harris Ran as Biden

While many people think Harris ran as a moderate, to be more precise, Harris ran at the exact point on the ideological spectrum that Biden governed. The illusion of being a moderate was created because she shifted her policy stances from where they were in 2019 (confiscating guns, in favor of trans surgeries, opposition to fracking, in favor of Medicare for All), up to but never beyond the positions Biden held in 2024. While she renounced her previous, left-wing positions, she often didn't provide a detailed policy proposal of her own, but when enough detail was provided, she it would perfectly match Biden's policy.

Her response to every question regarding immigration policy was to support the Lankford Immigration Bill which Biden had supported, but did not have support of enough Republicans to pass. She never proposed or accepted any measure that wasn't part of that bill. On Israel/Gaza, she used the same language and answers Biden gave, that there needed to be a cease-fire and the hostages needed to be returned. There was no daylight between her and Biden on any issue.

Despite many opportunities, Harris refused to stake a position closer to the center than Joe Biden on any issue. She famously told The View and Stephen Colbert that she wouldn't do anything differently than was done by Biden. She adamantly refused to move closer to the Center than Biden governed, and that put her to the left of the median voter.

Donald Trump Ran as a Pretty Moderate Republican

Meanwhile, President Trump ran pretty close to the center. It surely doesn't seem that way because of the parts of his campaign that the media chose to highlight, but he is the least conservative president in decades on abortion, saying he does not want a national ban and he's not sure about Florida's six week ban. On immigration, probably his rightest-leaning issue, he supports deportations, but so do 51% of Americans. It flew under the radar, but Trump also indicated that he wanted to give citizenship to any immigrant who gets a degree in the US, which is surely popular.

One can also consider the outcomes of the Senate elections. Which states flipped? West Virginia, where a Democratic Senator, while a thorn in Democrats' side, eventually agreed to the Inflation Reduction Act, which sealed his fate. Montana and Ohio's Senators lost resoundingly, both red states with moderate Democrats who had won before but voted with Biden on everything. Voters are tolerant of moderates to an extent, but that tolerance was exhausted by Biden's governance.

In the end, Trump ran much closer to the center than Harris, and Harris lost because of it.

Footnotes

1 This would have ended up an electoral tie, which Trump would have won in the House.