Blog

Friday, March 21, 2025

Making Up for DOGE

In light of the Trump administration and DOGE’s antipathy towards foreign aid and NIH, and their significant budget cuts, the most moral and productive thing that can be done, for those who strongly disagree with these decisions and are concerned with the hardships they’ll cause worldwide is to donate money directly to the affected programs.

Below, I’ve identified the entire costs of these programs, but also try to break them out individually. I’ve also calculated how much each person would need to donate to make up for the cuts and, where I could, pointed to some organizations that have a history of addressing the same issues.

I encourage you to share any other organizations you come across that could fill in the gap. Also, if you have any links to news articles that identify some of the most effective programs within these agencies, please leave them in comments, and I’ll see if I can add them in to the estimates.

US Total Expenditures on Foreign Aid and Research

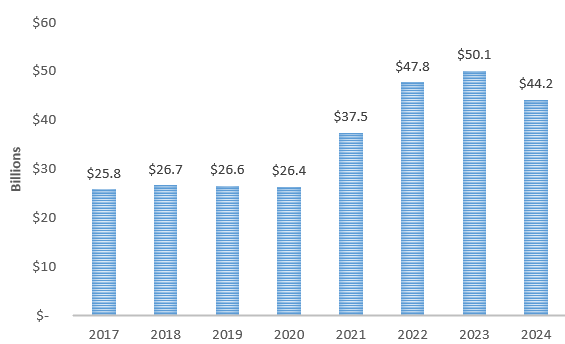

US Aid Budget by Year

- While USAID is the largest component, the entire foreign aid budget is $71.9 billion.

- The NIH budget is $47 billion.

Some Background Math

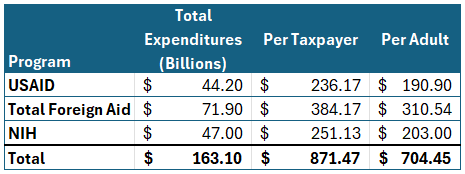

For tax-year 2022, the most recent-available, there were 161,336,659 total tax returns filed. Of these, 55 million were married filing jointly, 4 million were married filing separately, 21 million were heads of household, and 81 million were individuals. Since some of the 55 million married filing jointly were dual earners, I determined the total number of tax-payers by assuming 48.9% of the married couples were dual earners. That comes out to 187,155,980 earners paying federal income taxes, if my math is right. As an alternative number, there were 231,529,762 Americans over the age of 25 in 2023.Filling the Gap

The table below shows how much each adult or taxpayer would need to contribute to completely replace the programs. For example, if NIH were completely eviscerated, because the federal government spent $47 billion on it, each taxpayer would need to throw in $251.13 to make up for the loss.

Obviously, reality is much more complicated. Perhaps you want to make up for your NIH-skeptical friends and double your contribution. And, at this point, it’s not even clear that NIH spending will be cut, without Congressional approval. Also, maybe you want to focus your charity on the most effective aspects of these programs and not everything.

Individual Components

USAID

On March 10th, Secretary Rubio announced the review of USAID programs was done and they were cancelling “83% of programs at USAID.” Because “programs” could encompass small projects and large, it’s unclear how to translate that to a dollar figure. Fortunately, the Center for Global Development estimates the dollar figure to be around 34% of the annual spending. Of course, the normal caveat remains, that this money, as of now, still must be spent on foreign aid, it’s just Rubio and the new Trump-designated team that will direct it.

In addition, one might suspect that the programs cut would be the least beneficial and they maintained the most effective ones (the ones that would be the most difficult to defend cutting to voters), but nevertheless, 34% of USAID amounts to $15 billion.

The other major USAID program is PEPFAR, the US President’s Emergency Plan for AIDS Relief. Created by George W. Bush, PEPFAR provides relief to people living with AIDS around the world and is credited with saving more than 25 million lives.

The FY 2024 funding was $6.5 billion. Now, while that funding hasn’t been cut, it’s not getting to the people who need it, so the best use of dollars would probably address some of that gap.

Some organizations that overlap with PEPFAR

- The Global Fund (to fight AIDS, Tuberculosis, and Malaria)

- AIDS Healthcare Foundation

- UNAIDS

- AIDS Foundation South Africa

- Elton John AIDS Foundation - has a “Rocket Response Fund” as a direct result of US cuts

Notes

Thursday, March 20, 2025

Making Up for DOGE II

While a majority of Americans support government funded scientific research, and many support foreign assistance, people often argue that foreign aid and government-funded research are miniscule parts of the federal budget so don't matter, but when you How much does the typical taxpayer contribute to foreign aid and NIH? The answer will probably surprise you. Lower than you might think.

Firstly, as of 2024, US government revenues were 17.1% of GDP, while expenditures were 23.4% of GDP. This means, in 2024, revenues made up only of government revenues only cover 72.9% of government expenditures, so we can say that only 72.9% is paid for by taxes, the rest is paid for by debt-purchasers.

Of all government revenues, income taxes make up about 49%. The next largest portion, 35%, comes from payroll taxes, but since payroll taxes are meant for Social Security and Medicare, they are not used for foreign aid or NIH. Because Social Security and Medicare make up a significant portion of US spending, and they're paid for, in part, by separate payroll taxes, these programs should probably not be included in these calculations.

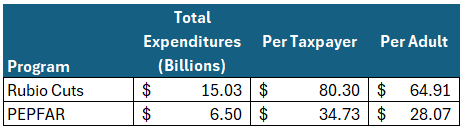

As a result, individual taxpayers pay only 56% of the cost of NIH and foreign aid. However, even this doesn't tell the full story. Because the federal income tax is progressive, not everyone who pays federal income tax pays for the same share of government.

Proportion of Income Taxes Paid and Discretionary Spending by Income

| Annual Income Range | Proportion of Total Income Taxes Paid | Contribution to Discretionary Spending (%) |

|---|---|---|

| $0 - $25,000 | 0.4% | 0.2% |

| $25,000 - $50,000 | 3.5% | 1.9% |

| $50,000 - $75,000 | 5.4% | 3.0% |

| $75,000 - $100,000 | 5.8% | 3.2% |

| $100,000 - $200,000 | 19.5% | 10.9% |

| $200,000 - $500,000 | 22.2% | 12.4% |

| $500,000 - $1,000,000 | 11.5% | 6.5% |

| $1,000,000+ | 31.8% | 17.8% |

Note: Percentages are author's calculation based on Table 3.5 (2022 version) from IRS Statistics site - https://www.irs.gov/statistics/soi-tax-stats-individual-statistical-tables-by-tax-rate-and-income-percentile

Proportion of Discretionary Spending Paid by tax filers, based on income

Author's calculation

Accounting for all of this, taxpayers contribute much less to NIH and foreign aid than they might first think. The table below lays out the per tax-filer income tax contribution to these programs based on income level.

Total Contribution to Various Discretionary Programs, based on income

| Income Range | Total Foreign Aid | USAID | NIH |

|---|---|---|---|

| $0 - $25,000 | $3.01 | $1.85 | $1.97 |

| $25,000 - $50,000 | $37.57 | $23.10 | $24.56 |

| $50,000 - $75,000 | $90.60 | $55.70 | $59.22 |

| $75,000 - $100,000 | $153.50 | $94.37 | $100.34 |

| $100,000 - $200,000 | $303.02 | $186.28 | $198.08 |

| $200,000 - $500,000 | $891.78 | $548.21 | $582.94 |

| $500,000 - $1,000,000 | $2,777.15 | $1,707.23 | $1,815.38 |

| $1,000,000+ | $15,938.36 | $9,797.99 | $10,418.68 |

Total program costs can be found at previous post on subject. https://chrisoldman784482.substack.com/p/making-up-for-doge