Blog

Thursday, March 27, 2025

Medicaid Provider Taxes - An Explainer

One branch of the current discussion regarding Medicaid and the Sword of Damocles that is the Republican Budget package that looms over it regards provider taxes, and how they are used by states to boost the federal money that comes into the state to pay for Medicaid without contributing anything themselves. Many people on the right and the left have acknowledged how these taxes are an abuse of the Medicaid funding system.

How Provider Taxes Work

While most taxes are imposed on individuals and corporations broadly, provider taxes are levied against health care providers like hospitals and doctors, specifically, as their name implies.

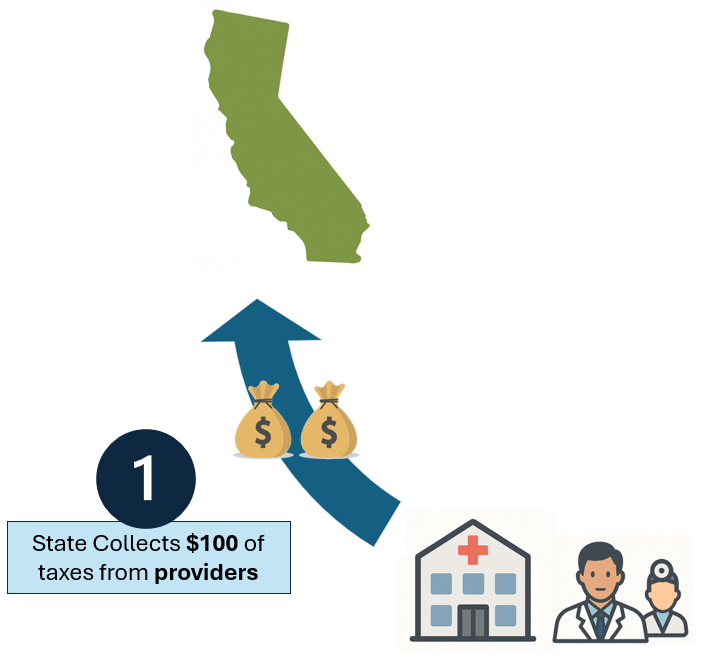

Step 1: States tax the health care providers and hospitals in the state.

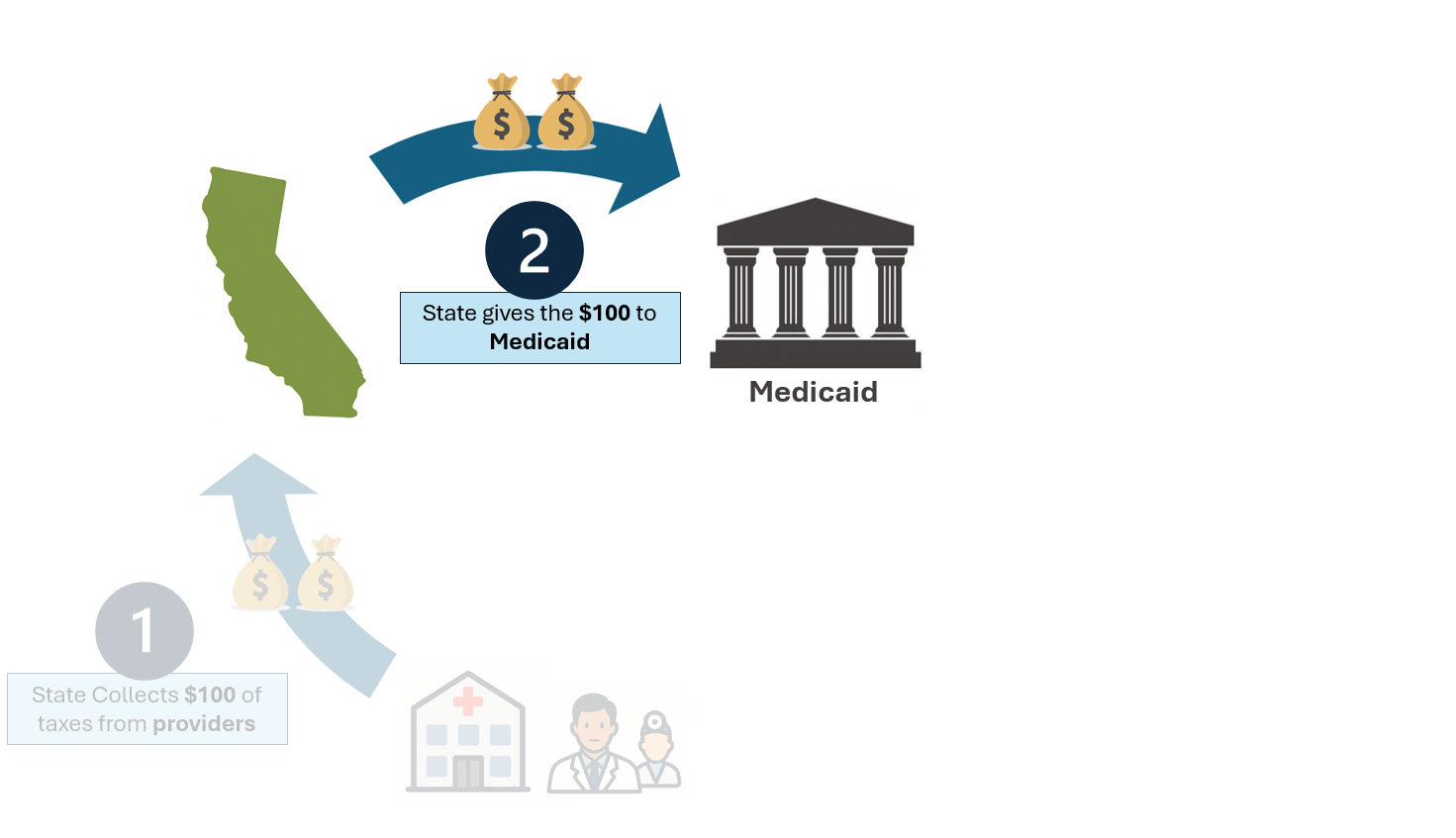

Step 2: The state gives that money to Medicaid.

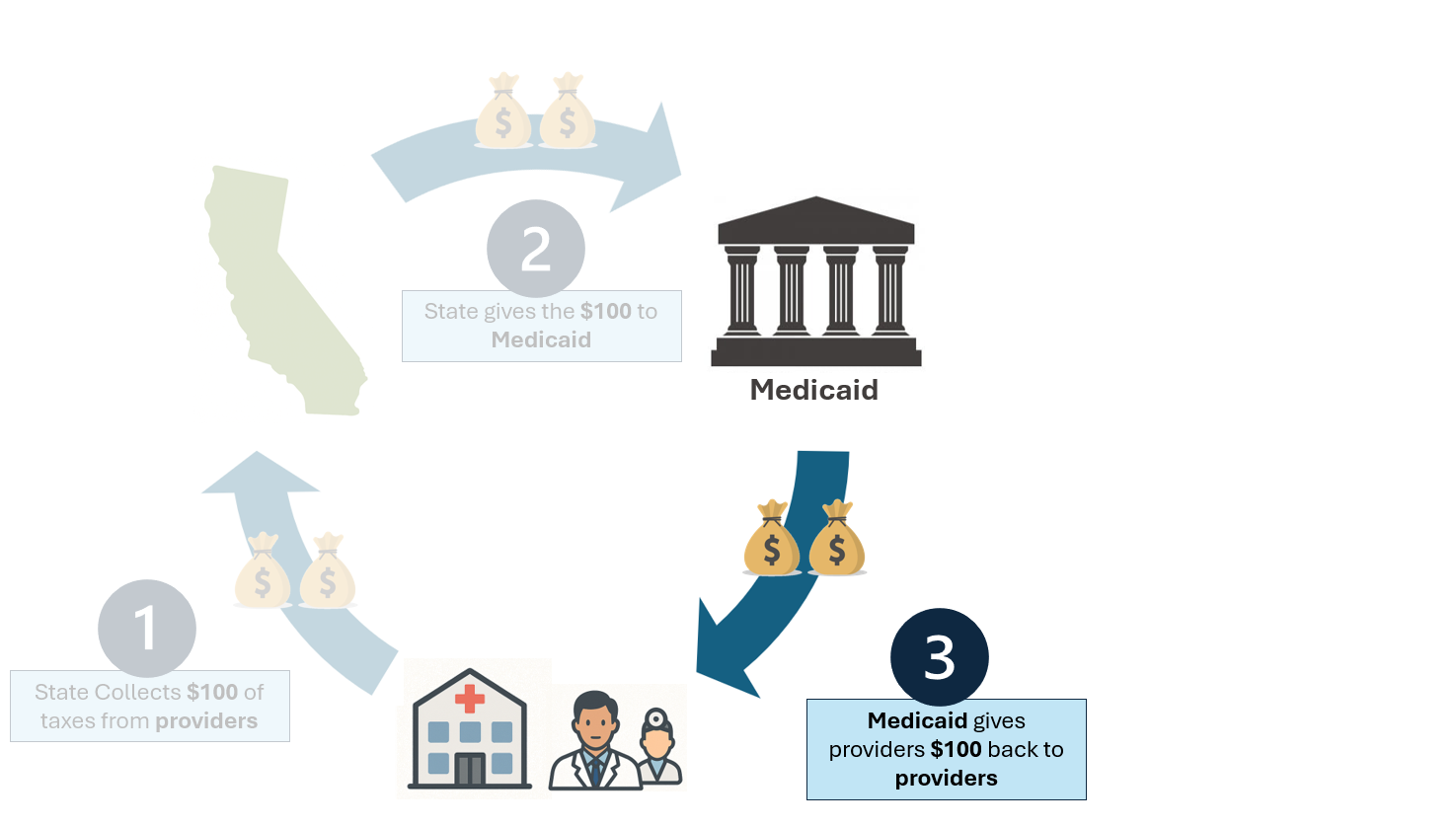

Step 3: Medicaid pays those same providers for providing care to Medicaid beneficiaries.

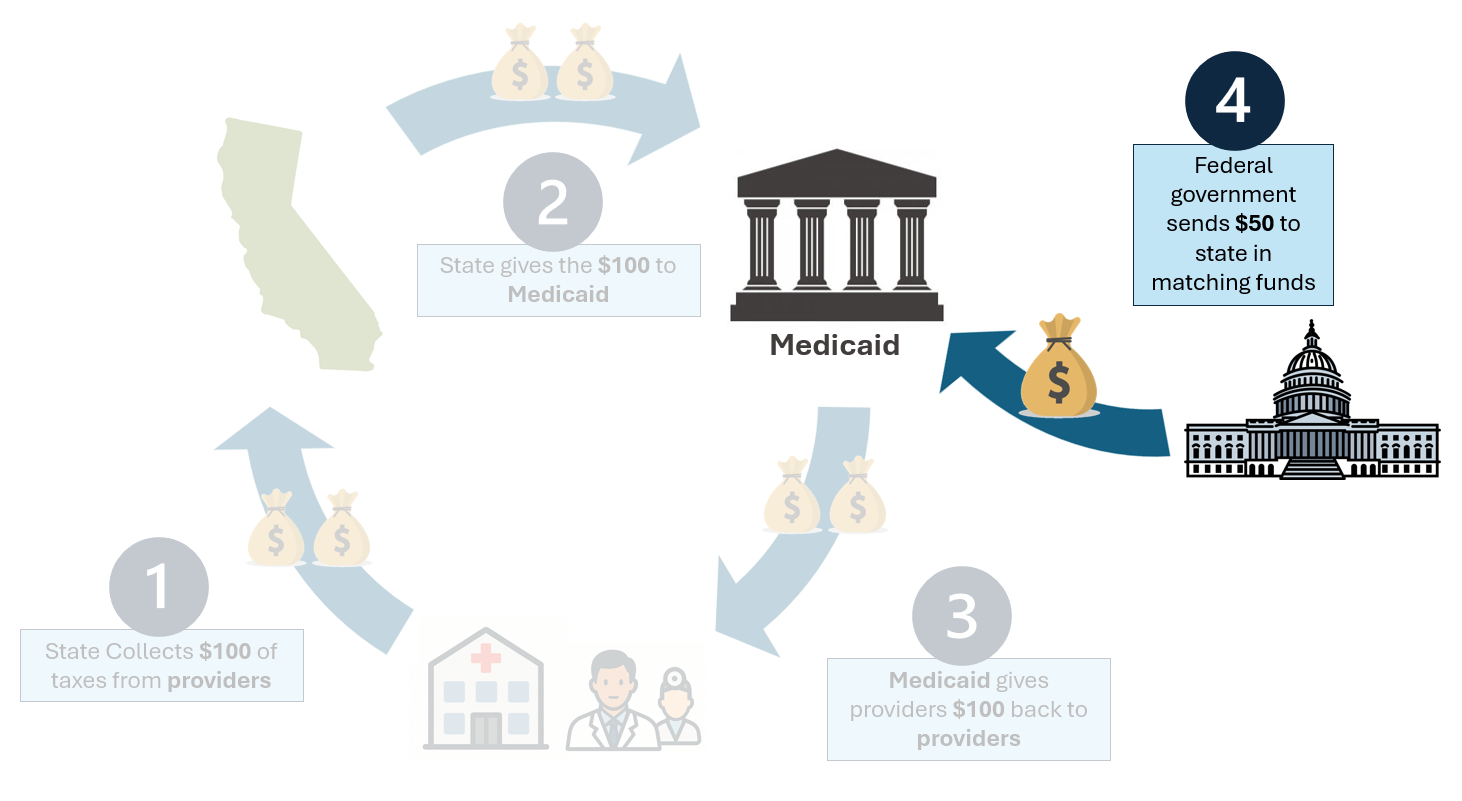

Step 4: The federal government matches a portion of that money that was taxed and returned to the providers, leaving no one in the state actually worse off from the tax.

In this process, the state has ostensibly taxed providers, but since it gave the same money back to them by paying them for care on behalf of Medicaid beneficiaries, their net tax is zero. Meanwhile, taxpayers in other states have sent additional matching money under the notion that the state was contributing.

By doing this, states break the state-federal Medicaid funding compact, where the Federal government contributes to Medicaid, which is a state-administered program, matching the contributions that the state makes itself. In this case, the state doesn't contribute anything, but runs a shell game to get the match anyway.

Effectively, this allows the state to increase the federal match rate beyond what it should be, getting a 70% from the federal government, instead of, say, 65%. Some estimate the shift to be as high as 14 percentage points.

Modern Medicaid and MCOs

In the last few decades, Medicaid has transitioned from a largely Fee For Service model (patient gets procedure, state pays hospital for procedure), to a managed care model (patient chooses an insurance company, state pays insurance company a fixed amount of money, and the managed care plan or MCO interacts with the providers.

State taxes on MCOs were subject to the same provider tax limits as those on providers. Most importantly, taxes had to be broadly applied, as in not just to Medicaid MCOs but commercial MCOs as well. In 2023, however, California implemented a tax on MCOs that was higher for Medicaid MCOs than commercial, charging MCOs $182.50 per Medicaid enrollee but only $1.75 for private enrollees.

Because of legacy formulas that CMS uses to determine compliance, CMS was forced to allow this tax, even though it ostensibly violates the broad application requirement. CMS is in the process of modifying its rules so that it can reject this tax, but it will take several years to go through the administrative process. In the mean time, other states are following California's lead.

Hold Harmless and Safe Harbor

The 1991 reforms didn't go all the way. Before 1991, states were free to tax only Medicaid providers, and circulate 100% of the taxed money back to them. The 1991 reforms both (1) prevented a tax on Medicaid-only providers and (2) forbade provisions that would have the effect of returning the money to those providers selectively. These are known as "hold harmless" provisions because they would ensure that the tax was harmless to the Medicaid providers by increasing reimbursement rates for Medicaid procedures, as an example.

The reforms did not entirely prohibit methods states took to return the money to Medicaid providers directly. As long as the overall provider tax was less than 6% of provider revenue, and the state's reimbursement system funneled less than 75% of the provider taxes back to these providers, then the government wouldn't challenge it. These allowances are known as the "safe harbor" because they allow the states and providers to use the tactic to an extent, without scrutiny.

The Congressional Budget Office estimates that eliminating these safe harbors entirely could save $612 billion over 10 years.

Some History

This scenario has long been recognized as abusive. In the 1980s, it became so prevalent, that Congress actually passed a limited fix for it. The law was supposed to ensure that any taxes were applied broadly to different provider categories, to prevent states from selectively taxing Medicaid providers only. It also allowed states to take advantage of the provider tax loophole just so long as the tax rate on the providers didn't exceed 6% of their revenues. While this didn't solve the problem, it did constrain it.

Politicians from both parties have recognized this practice for the abusive, shell game to get around the state contributions while still receiving a federal match. Joe Biden called it a "scam" when he was Vice President. President Obama pushed for reforms. The Washington Post favored reform. Democratic Senate Leader Dick Durbin also called it "a bit of a charade".

Informative Links

Fiscal Policy Institute

Kaiser Family Foundation

Paragon Health Institute

MACPAC