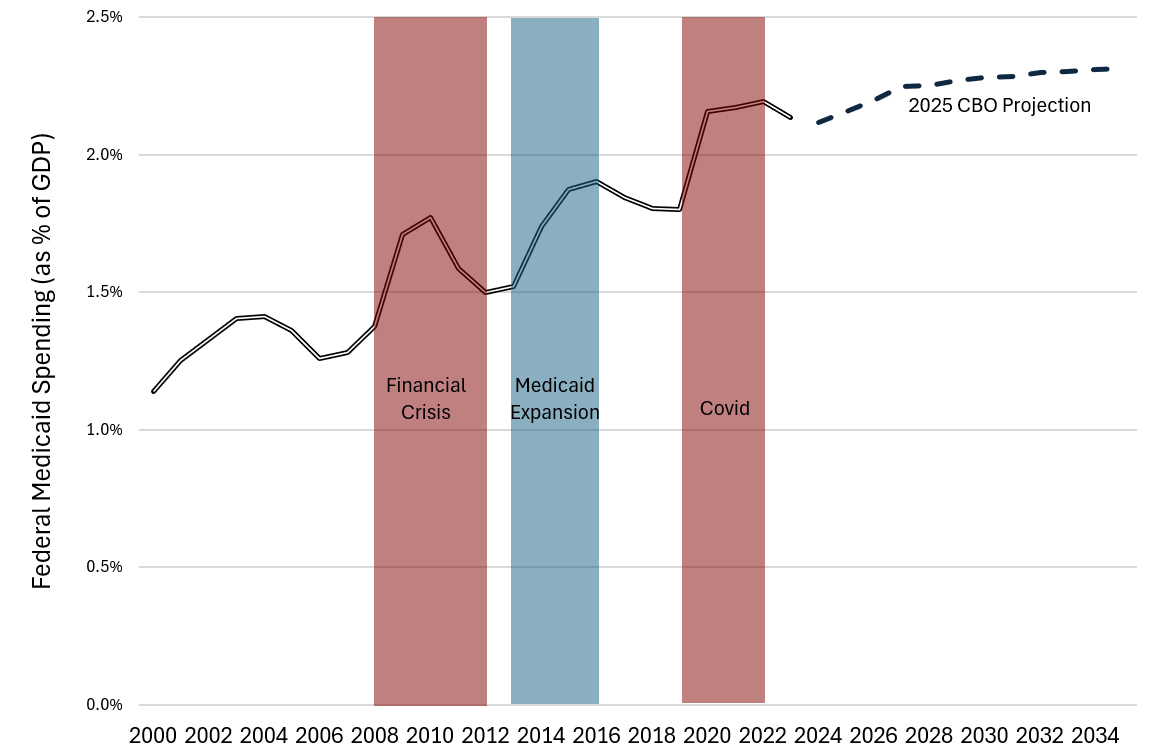

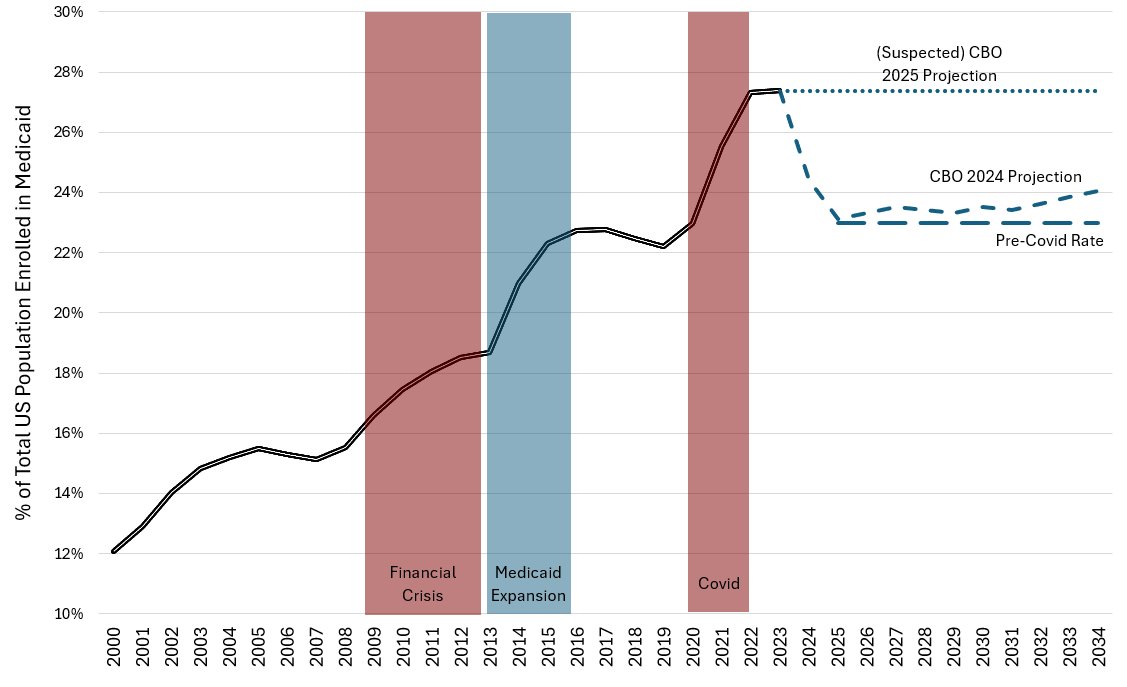

Congress tasked itself with reducing spending on Medicaid, Medicare, and some other expenditures by $880 billion over the next ten years. Many argue that this is impossible without harming America's most vulnerable, but this is not true. What most Americans don't realize is that Medicaid has grown considerably over the past twenty years, even outside of the ACA expansions, and the cuts being discussed would still leave it bigger than it was before Covid, not just in total size but per capita and in proportion to the economy.

Federal Medicaid Spending as a % of GDP

Source: Author Calculation based on NHE (Actual Federal Medicaid Expenditures), FRED (Actual GDP), CBO (Projected Medicaid and GDP)

Below are some of the most discussed proposals to reduce the size of Medicaid, and estimates to how much money they'll save. They will have different impacts on enrollment and per-beneficiary costs—some will pare back enrollment while others might reduce the received benefits, but it's important to understand that none of them will leave Medicaid smaller or less generous than it was during the Obama years, when no one was arguing that Medicaid was insufficient.

Proposals to contain Medicaid, and how much they'll save:

- Eliminating Waste, Fraud, and Abuse - $91.2 billion

- Work Requirements - $109 billion

- Balancing out federal match rates - $626 billion

- Limiting the Provider Tax Exemption - $630 billion

- Limiting Per Capita Cost Growth to inflation + 1% - $848 billion

- Making sure Medicaid grows no faster from 2026-2035 than it did prior to the pandemic - $778 billion

- Getting Medicaid back to its pre-pandemic size - $1.4 Trillion

Eliminating Waste, Fraud, and Abuse

It's bipartisan and inoffensive to all. Perennially over-estimated yet persistent despite its permanent position in the crosshairs. CMS estimates that 5.1% of Medicaid payments lack appropriate paperwork, and that 20% of these are truly improper. This produces $91.2 billion in potential savings over ten years.

Adding Work Requirements

Work requirements are pretty simple in principle—require able-bodied adults without children to work 20 hours per week to be eligible for Medicaid. There's much debate on their benefits and effectiveness. CBO estimates that such work requirements would save $109 billion over ten years.

Equalizing Federal/State Matching

When the ACA was passed, it expanded Medicaid to everyone earning up to 138% the federal poverty line. Importantly, for the people who were newly eligible for Medicaid, i.e. not the most vulnerable of the vulnerable who Medicaid originally targeted when it was created, the federal government would reimburse 90% of the costs instead of 50% under original Medicaid. Many have pointed out that that's backward, and the newly eligible should be matched at the same rate as original Medicaid—50%. Further, the states that chose not to expand Medicaid still only receive the 50% matching rate.

Dropping the 90% matching rate down to 50% to treat every beneficiary the same, and reducing the incentives for states to focus on less vulnerable recipients, would save $626 billion over ten years.

Limiting the Provider Tax Exemption

In a previous post, I wrote about the state provider tax, what it is, and how states use it to extract more federal dollars from Washington than they would otherwise be entitled to. Current law, which was written to limit the manipulation of the provider tax, included an exemption of a sort, that allowed states to use provider taxes up to a certain limit without drawing scrutiny. By eliminating that exemption, the federal government would save $630 billion over ten years, according to the CBO.

Limiting Medicaid Per-Capita Growth to Medical Inflation+1%

Medicaid benefits are growing much faster than inflation. CMS could forego reducing enrollment but instead limit the growth of benefits to slightly more than medical inflation and still save $848 billion. This would simply entail ensuring that the benefits package for Medicaid enrollees remains relatively locked and doesn't expand to include additional services than beneficiaries currently receive. See more at the Manhattan Institute.

Returning Overall Medicaid Growth Rate to its Pre-Covid Level

Currently, the CBO projects that Medicaid will grow around 5% per year for the next ten years. Conversely, from 2015 through 2019, after Medicaid expansion but before Covid, Medicaid's growth rate was a smaller 3.1% per year. Simply limiting Medicaid growth to this historically reasonable rate would save $778 billion over ten years.

More details can be found here.

Returning Enrollment to its Pre-Covid Level

% of Total US Population enrolled in Medicaid by Year

Source: Author Calculation based on NHE (Total Medicaid Enrollment), CBO (Projected Medicaid Enrollment). Note: The 2025 CBO projection for Medicaid spending is substantially higher than the 2024 CBO projection, but they have not yet released the breakdown. The dotted line represents a higher level of enrollment which could explain the higher CBO estimates.

During Covid Medicaid grew in size to handle the emergency, but never went back down. Medicaid surely includes more than America's most vulnerable, unless one out of every four Americans should be considered vulnerable. Cutting Medicaid enrollment from it's post-Covid level of 27.5% of the U.S. population back to the maximum level previous to Covid (23%) would save $1.4 trillion over 10 years.

More details can be found here.

Conclusion

Medicaid has grown substantially in the past ten years, even beyond what was passed in the ACA. It has grown to cover more than one out of every four Americans, even though it was designed to cover only the most vulnerable. High-spending politicians and non-profits continue to claim there's no space for shrinking Medicaid even by one dollar without harming those least able to provide for themselves, but the past seven years of expansion prove the opposite.