Header image used without permission from Reason

Both Sides of the Spending Cuts Debate

The DC set is currently in its decennial debt-ceiling fracas. Since there's a Republican-controlled House and a Democratic president, it's time to argue over the debt. Republicans want to reduce spending and Democrats want the authority to spend every dollar that's been legislated.

The Republicans passed a bill that would reduce spending by $4.8 trillion over the next ten years, according to the CBO. The primary element of the plan would reduce discretionary spending, starting in 2024 to the same level as in 2022, and then grow it by 1% per year. (See here for other elements)

Democrats have criticized this plan for cutting spending.

House Republicans would rather take health care away from millions of Americans than have the wealthy and big corporations pay their fair share. pic.twitter.com/GJymOPcwYi

— The White House (@WhiteHouse) May 9, 2023

While President Biden’s budget upholds our nation’s sacred obligation to care for our veterans and invests in our seniors, MAGA House Republicans are pushing cuts that would threaten critical services. pic.twitter.com/JOWMUp8WtL

— The White House (@WhiteHouse) May 8, 2023

House bill cuts nondefense discretionary spending by 28% or 58% (depending on assumptions) in real per cap terms by 2033. NDD includes infant nutrition, border security, Pell, FBI, housing subsidies, etc.

— Catherine Rampell (@crampell) May 1, 2023

Which of those will get targeted? GOP can technically claim none of them!

The left-leaning Center for American Progress even did its own analysis of the budget cuts and called them "deep programmatic cuts", "slashing funding by nearly 60% within a decade". While I was unable to replicate their findings, I do like their approach of calculating spending per person. I also think some historical context is opportunistically elided.

Context

Since 2000, non-defense discretionary spending (basically the part of the budget that politicians have the most power over, which doesn't include Social Security or Medicare spending), has increased by 68% in real terms! Over the same period, the US population only increased by 18%, which means that, per person, discretionary spending has increased by 43%.

This is the same number CAP wants to focus on, real discretionary spending per person, and it's what is used in its analysis. Theoretically, a government that provides the same services over time should be spending approximately the same amount per person. Its spending has to grow to accommodate more people, and in fact, should probably fall per-person as larger organizations are generally more efficient.

But instead, the per person spending has increased by 48%, meaning the services provided, the staff providing them, or inefficiency have grown over that period. It's against this growth that Republicans want to begin to rein in spending which Democrats are calling draconian.

Per person, inflation-adjusted spending has increased by 48% since 2000, excluding Social Security, Medicare, Medicaid, and defense.

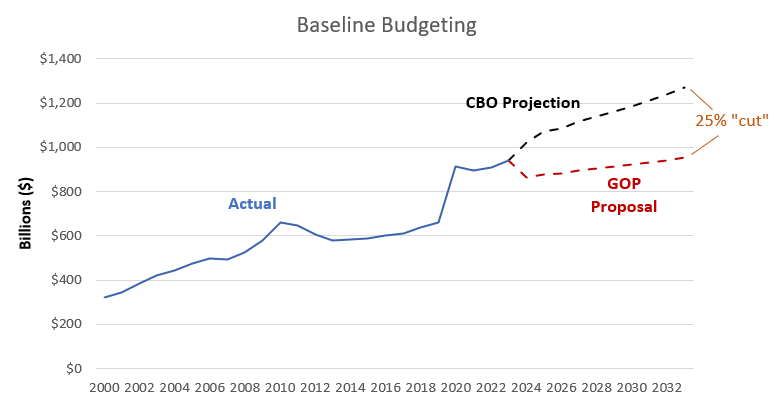

The below chart shows the CBO projection (black dashed line) against the historical context (solid blue line) and the GOP proposal (red dashed line). Spending increased gradually from 2000 to 2006, dipped slightly before jumping after the 2009 financial crisis. Then it fell again and held mostly steady until Covid and it set a new record high. It fell slightly, but was still significantly higher than the 2012-2019 norm.

From there, the CBO projects an increase followed by a slight decline while the GOP proposal would immediately cut it to still-above 2019 levels and keep cutting until it fell back to 2002 levels. It should be noted that even if this budget proposal gets passed into law, which it won't, the chances of this decline happening given future Congress's penchant for spending is nil, but it is important to understand how this proposed spending compares to recent years.

Fun with Cost Bases

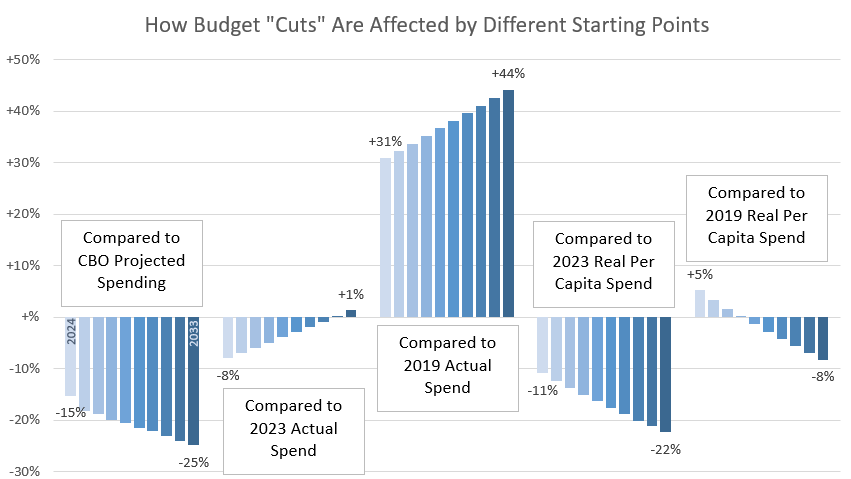

Readers should always take budget cut projections with a grain of salt, because whereas most people think of budget cuts as 'how much lower will future spending be versus today', when dealing with the federal budget, journalists and Democrats report budget cuts as 'how much lower will future spending be versus projected future spending.' And because projected spending already includes increases, the budget cut figures are always inflated.

This is illustrated in the figure below.

There are other ways, too, to report the change in spending. You could compare to the most recent year, you could compare to before the pandemic started, or you could compare to either of those two, after correcting for inflation and accounting for population growth. The below chart shows what cuts would look like based on four different bases.

In my view, the best one to use is the last one, comparing the spending per capita, inflation-adjusted to 2019, the last pre-pandemic year. Unless you think there's a reason for size of government to have increased post-pandemic, the spending per person should be roughly the same as then. Another reason to use this as a benchmark is that this figure stayed roughly the same from 2003 through 2019 except for the financial crisis period.

Most people would agree that government might need to be larger during crisis periods, therefore smaller in non-crisis periods. After the financial crisis, the size of government shrunk back to its pre-crisis size, and there's a strong argument that it should do so again today, not maintain its pandemic levels.

After the financial crisis, the size of government shrunk back to its pre-crisis size, why shouldn't it follow the same pattern post-pandemic?